Oil gas updates - prices rallied on possible production cut

391

21 October 2016

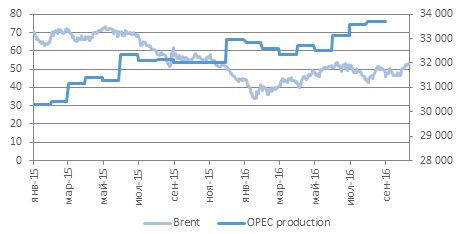

Russian president expressed readiness to support an OPEC output cut at the World Energy Congress on 10 October, sending oil prices to one-year high levels. Brent crude rose by more than 3% to USD53.73pb on 10 October. US crude was up 3.33% at USD51.47pb. OPEC has agreed to limit production by 0.7%-2.2% to 32.5-33.0mln bpd. OPEC's current output is a record 33.6mln bpd.

Representatives of some OPEC members and non-OPEC countries including Russia, Azerbaijan and possibly Mexico will hold a round-table meeting on 12 October. Any deal would initially be applied over six months and then reviewed. The 14-member oil group said it will not finalize details or complete its production agreement until the group's next official meeting in Vienna on November 30.

Nevertheless, higher production from Libya, Nigeria and Iraq are reducing the odds of such a deal rebalancing the oil market in 2017. Iran wants to ramp up output to more than 4mln bpd when foreign investments in its fields kick in. Saudi output has risen to 10.7mln bpd from 10.2mln bpd in recent months due to local needs for summer cooling. OPEC sources have said Saudi Arabia offered to reduce its output from summer peaks of 10.7mln bpd to around 10.2mln bpd if Iran agreed to freeze production at around current levels of 3.6-3.7mln bpd. Russian Energy Minister Alexander Novak said that the world's top producer would cap its current oil output if a deal is signed. Russia pumped 11.2 mln bpd in September.

OPEC oil supply vs. Brent price, USD pb (2015 – September 2016)

Source: Bloomberg, Samruk-Kazyna

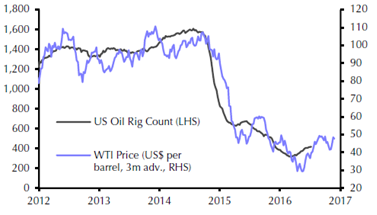

US production might ramp up

Market players continue to focus on US drilling prospects, amid indications of an ongoing recovery in drilling activity. Oilfield services provider Baker Hughes indicated on 7 October that the number of rigs drilling for oil in the US last week rose by 3 to 428, marking the 14th increase in 15 weeks. Some analysts have warned that the current rally in prices could be self-defeating, as it encourages US shale producers to drill more, underlining concerns over a global supply glut. US shale producers should be incentivized by oil prices moving through the USD50-USD60pb range and above, witnessing sustained growth for several years.

September's global rig count of 1,584 was up 2.39% on August, the vast majority of which was from Canadian and US rigs coming online. Additionally, this latest global rig count is now appreciably higher than this year's average figure of 1561.

US active oil rig count & oil prices

Source: Thomson Reuters, Baker Hughes

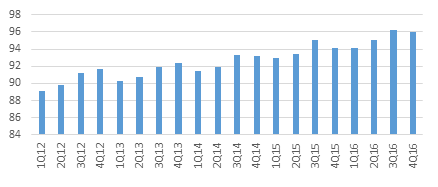

However, even if the prices do not rise above the USD50pb, it is less likely to see the commodity prices slip. This is largely a result of the growth in demand for oil that has been seen over the past number of quarters. Demand has been increasing steadily and whilst it has been unable to keep pace with the increased supply, it is at least trending up again.

World oil demand

Source: OECD, IEA

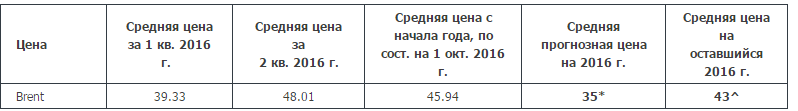

Oil price outlook

We expect global oil prices to remain volatile in the near-term, as OPEC cuts remain questionable despite recent developments. However, if a reduction in output will actually happen, it will be negated by the increased output from shale producers in the US, since their production becomes profitable at oil prices above the USD50pb mark. As such, we maintain our in-house projection for oil price at USD43pb average for 2016.

Oil Price Projections 2016, USD per barrel

Source: Bloomberg, Samruk Kazyna

* represents official projection (by Ministry of National Economy), average price expected for full year 2016

^ represents in-house projection by Samruk Kazyna, average price expected for remaining of 2016

Projections were based on data as at 30 September 2016

Рекомендуем

{{ $t('messages.news1') }}

The Management of Samruk-Kazyna JSC Met with a Delegation from the Sta...

{{ $t('messages.news1') }}

Nurlan Zhakupov, Chairman of the Management Board of Samruk-Kazyna JSC...

{{ $t('messages.news1') }}

Gas Industry Development: QazaqGaz to Report on Results and Projects

{{ $t('messages.news1') }}

A Number of Documents Signed by the Samruk-Kazyna Group during the Vis...